Real Estate Saccos Conning Unsuspecting Kenyans

Many Kenyans with little or no income would find it hard to invest in the real estate sector since it requires a large capital and therefore opts for joining Saccos in order to finally own stakes in the massive real estate industry.

Some Real estate Sacco’s have swayed Kenyans to invest with them with the promise of owning land or rental houses through membership loans.

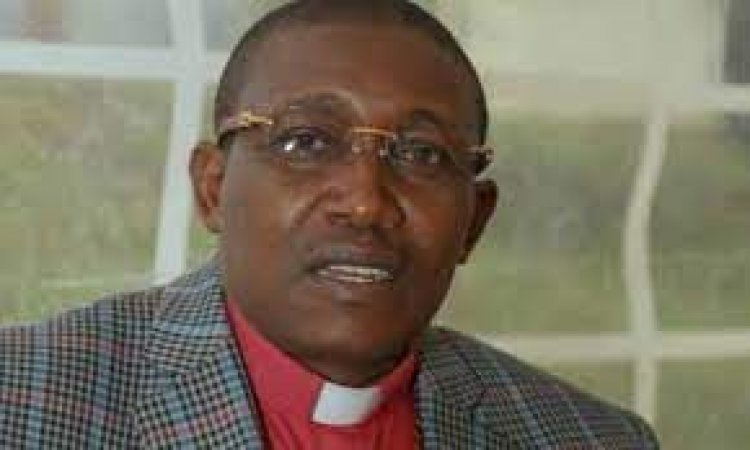

Ekeza Sacco, a Real Estate firm under David Ngare Kariuki aka Gakuyo a televangelist at Calvary Chosen Centre Church in Thika, has in the past few months made the headlines over swindling Kenyans through his real estate firm. Social media had been awash with testimonials of his victims crying foul and imploring the government to intervene on their behalf.

It was alleged that he siphoned over 1.5 billion that had been saved by 78,000 people at the Sacco, money that he allegedly later used to buy personal property. Although this may sound like robbery without violence, it takes meticulous planning that involves sophisticated play with the emotions of their target audiences.

Mr.Gakuyo is said to have only remitted money for a few people and later stopped after a duration. The members of the Sacco have been taken in circles as they seek compensation for their investments which backfired. This matter was however presented before the Director of Criminal Investigation (DCI) where thousands of the members were asked to record their statements.

You may be wondering how all this happened, let’s break it down. In a lifestyle audit report that was carried out only 507,900,374 could be traced to the members who took loans from the troubled Ekeza Sacco to acquire properties, the rest, which added up to roughly sh.1.5 billion was transferred illegally to the accounts held by Mr. Gakuyo, Mr. James Wanjuu(Vice-chair) and Ms. Gladys Murithi the Sacco’s secretary.

While Saccos can increase a person's investments for instance members being able to buy chunks of land as a group which is later subdivided amongst them and can later buy their own homes or use the land as a surety against borrowing or even wait for the lands price to appreciate so they can cash in and rake in the profits. Reports indicate that 6,000 cases of fraud were reported in 2016 and according to the Kenya National Bureau of Statistics (KNBS) it is easier to be conned when it comes to group investments.

Therefore, to prevent further occurrences of such instances, you need to carry out a lot of due diligence regarding the authenticity of any Saccos you wish to trust to foresee your investments and savings. The country is filled with unscrupulous businessmen with get-rich-quick schemes that prey on unsuspecting Kenyans who may not do the required background checks before committing their cash into such avenues of saving.