Real Estate Investment Strategies for Beginners in Kenya

The advantage of real estate is that it is a very accommodating sector for all individuals. Whether experts or beginners, people of low income and the well-off, those seeking instant returns, and those that want long-term returns.

Real estate is a multibillion-dollar business around the world. In Kenya, it has started picking up, and it is booming. Many people have invested in real estate without having any physical land or property. That presents an opportunity to people of all walks of life as long as they have a little capital—as low as 5,000 shillings. As a beginner in the real estate sector in Kenya, one could opt to buy and hold properties, invest in REITs, buy rental properties, flip, and do land banking.

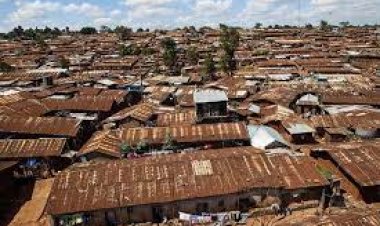

Buying and holding properties involves acquiring property from a seller and withholding it for the long term to sell it once its value appreciates. For example, one could buy rental properties and collect rent while they wait. These rentals could be on a plot that is anticipated to appreciate with time. Due to urbanization, the demand for land results in plot prices rising. This could be a comfortable way for a beginner to delve into the sector.

Investing in REITs means investing in real estate without actually owning it. This could be through buying shares in a company that owns property or has intentions to construct property. As an investor, an individual gets to earn dividends over time. The advantage of this method of investing is that it accommodates a large number of investors with very little capital. The money pool is used to come up with property, which then pays the investors over long periods of time.

Buying rentals could also be a good way to delve into the real estate sector for a beginner. This applies to people who have a good amount of money to invest at once. An individual buys already-constructed houses and rents them out. That way, they recover their investment from the tenants and earn profit after that. A beginner needs to ensure that they scout lucrative areas with high demand. They should also carefully vet the people they rent their houses out to, meaning that they pay their rent on time as well as provide a conducive living environment for other tenants.

Flipping involves buying property, innovating it, and then reselling it. This is also a good investment for an individual with a large amount of money to invest. This is because buying and renovating involves spending a lot of money. For a beginner, it is important to get an investment that gives back returns over a short period, even if they are not instant. The investor then ensures that the investment returns the purchasing income as well as the renovating money. For a beginner, this strategy is motivation to even delve deeper into the industry once the first investment provides returns.

Land banking is also a good investment for a beginner who has money that they want to invest but does not necessarily want instant results. This strategy involves buying undeveloped land with the anticipation that its value will increase as the area develops. Land banking could be a good investment opportunity, as it is low-cost and requires little maintenance. One only needs to purchase finances and probably fence funds, after which they leave the land value to appreciate with time.

Finally, the advantage of real estate is that it is a very accommodating sector for all individuals. Whether experts or beginners, people of low income and the well-off, those seeking instant returns, and those that want long-term returns. Beginners can choose which strategy suits their needs and efficiency and even adjust with time.

If you have a real estate press release or any other information that you would like featured on the African Real Estate Blog Post, do reach out to us via email at [email protected]

winniemaina

winniemaina