Residential Versus Commercial Property; What You Need to Know

While residential and commercial property share a similar characteristic in the sense that, both are tangible assets, they also differ in terms of returns, capital and income, therefore if you are debating on whether to invest in residential or commercial property, understanding the differences would be key.

Residential properties are mostly suitable for dwelling, where a property owner can live in the property or rent it out while commercial properties are used for non-residential activities like hotels and retail shops.

Residential property

They include Rental, Holiday homes and second homes.

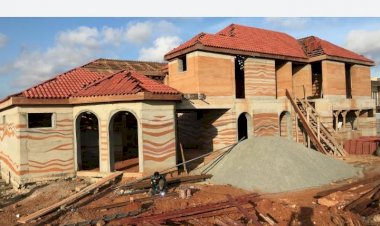

Commercial property

Is a property that is purchased in order to make a profit. They include Industrial property, Retail property, agricultural land, office development, block apartments.

Business operators often prefer to rent instead of owning a property where they would operate their businesses from as real estate is not their major business therefore, commercial property is supported by tenants who run their businesses to generate income.

Major differences

Lease

Residential properties have a shorter lease period, usually for one year while commercial properties have a long-term lease (over 10 years).

Returns Profile

Depending on the location of the property and the demand, commercial property yields approximately 5 percent to 8 percent per year while a residential property would yield 1 to 5 percent. Therefore the returns in commercial property are much higher compared to residential property.

Repairs

In residential property the owner is expected to take responsibilities for maintenance and repairs whereas in commercial property this is done by the tenant however in some cases it might vary depending on the agreement.

Entry

Investors of commercial property will put more equity in their project because it is sometimes hard for them to access banks debit, the banks also lend at lower Loan to Value (LTV) ratios compared to residential properties.

Banks loan up to 90 percent on the residential asset while in commercial property they lend about 40 to 60 percent. Commercial loans have a shorter period and involve heavy restrictions and penalties.

Value Appreciation

Commercial real estate investments have better value appreciation rates because commercial property owners earn money from leasing contracts and also from reselling the property.

While commercial properties have a higher risk, they would also yield a higher return. Therefore an investor, depending on his goals and objectives needs to make a suitable decision on the type of investment they want. With stable market conditions and proper management, both residential and commercial property would present strong investment opportunities.