Why Investing in the Underprivileged Areas Is better than investing in Posh Areas

Should you invest in the posh leafy suburbs or go for the lower-income and the middle-class areas? It is important to ask yourself this question before investing.

Sitting with an amazing lady having tea making small talk, we suddenly start talking about investing in apartments.

"It's never safe to build or buy a house in Posh areas like Karen if you want to rent it out as a source of income." She starts.

"Why?" I ask ready to be fed with information.

She takes a pen and writes down the numbers to show me the income difference before giving me two real-life examples of two of her friends who invested in real estate but in different areas.

"Friend A," she said, "took a loan, bought an expensive house in Karen to rent out for Ksh.400,000. The house has been vacant ever since. She has not yet cleared her loan debt."

Friend B, she explained; bought land in Ruaraka and built 24 apartments, and rented them out for Ksh.30,000 per house. The apartments filled up fast. That means in a month he gets

Ksh.720,000 and the one in Karen if she finally gets a tenant he would still earn less.

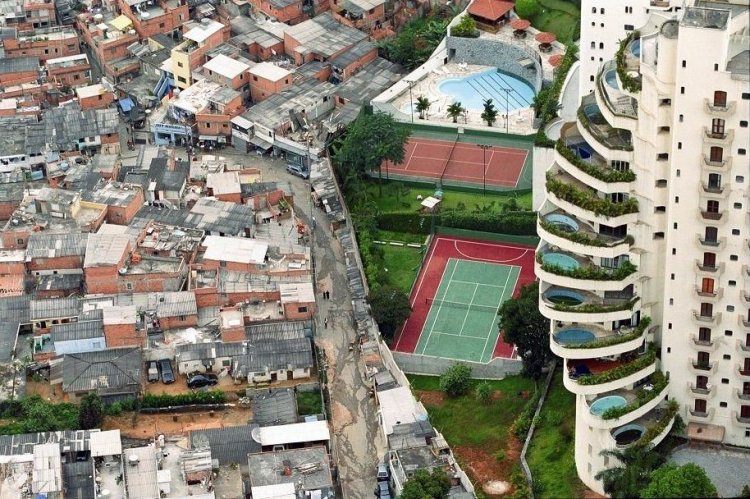

So from the conversation, these are the reasons why investing in poorer areas is not stupid.

1.The Market is Consistent

Lower-end properties are always in demand. This is because a larger population belongs to the average and lower socio-economic category and hence cannot afford to pay hundreds of thousands as rent.

A house in Karen that is rented out for say, Ksh 450,000 per month might stay vacant for months or even years before it can get a tenant. This is because the larger population of Kenyans do not even earn anything close to Ksh 450,000.

That means the investor will have a hard time paying back the loan taken to build that particular house. Sometimes the house might end up being auctioned and one's investment ends up being futile.

2.Underprivileged Areas have the Potential to Develop.

Take for example Rongai. It used to be a small center, but with various investments; hotels, apartments and supermarkets, the place has significantly developed. The development of a place can equal to rising in the value of homes in that place. So eventually your investment will appreciate.

3.Guaranteed and Steady Cashflow.

Building many smaller apartments in an underprivileged area as opposed to one big house in a posh area is safer. This is because: a)You are most likely going to have tenants in at least half your apartments in no time.

b)A tenant moving out will not affect your general income because they are not your only tenant.