KICC Auction: An Example of a Lien Sale

Liens can be filed by the government, small businesses or other financial institutions either voluntary or involuntary. Properties can be subjected to more than one lien.

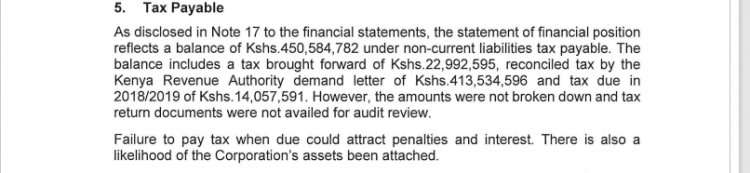

Report of the Auditor-General, Nancy Gathungu, on the Kenyatta International Convention Centre (KICC) for the year ended 30th June 2019, has sparked reactions to a possible auction of the Centre due to the arrears the corporation owes. KICC was established under the Tourism act of 2011 and is, therefore, a government entity. The Auditor-General in a section of her report stated that failure to pay taxes on time will attract penalties and draws the risk of its assets been attached.

A section of the report [photo/screenshot of Auditor-General report]

A section of the report [photo/screenshot of Auditor-General report]

This is not a new procedure, as many other properties have undergone this process to settle debts. Just like KICC, many other property owners are at risk of having their properties attached due to non-payment of various fees that include land rates, water and electricity bills among others. The property attached will have to undergo a lien sale in order for the creditor to recover the debt. This sale is done in a public auction.

A lien is a legal right notice that is attached to a property, indicating that a creditor claims that an individual owes them money. The creditor is referred to as a lienholder or a lienor, while the individual who owes the money is called a lienee.

A lien gives the creditor the legal right to take and sell the property given as collateral in order to meet the obligations of the loan or outstanding fee that has been defaulted. In such a case, the borrower cannot be able to sell the property under lien. Sometimes a lien can be on an inventory or unfixed property and this is referred to as a floating lien.

Liens can be filed by the government, small businesses or other financial institutions. There are different types of liens categorized into two:

- Voluntary/ Consensual

Lien on a property for a loan is consensual. This means that both parties (borrower and creditor) agree to have an asset placed as collateral.

- Involuntary/ Non-Consensual

Here the creditor files for legal actions for a default payment which results in a lien on assets owned by the defaulter.

Bank Lien

A lien will be granted when an individual takes a loan from the bank to buy an item. The seller is paid using the money borrowed from the bank and the bank, in turn, places a lien on the item purchased. If the borrower fails to pay the loan, the bank will sell the item to repay the loan. However, if the borrower pays the loan in full, the bank withdraws the lien and the individual takes full possession of the item bought.

Mortgage Lien

Before a lender agrees to give out a loan to buy a house they have to verify if the property has a clear title. This means that the house will act as security for the debt. The lender will then proceed to file the mortgage in the public lands records to put a lien on the property. Any other lender will file the lien as the second.

Real Estate Lien

This is the legal right to sell the real estate property in the case where the loan defaults. A real estate lien can be placed automatically by the lender, however, non-payment to other financial institutions can result in an involuntary lien.

Judgment Lien

A creditor can file a lawsuit against someone who owes them. If the creditor wins, the court will place a lien on the assets of the borrower. This will ensure that the creditor gets to be paid whatever he/she is owed without necessarily coming out of the pocket of the borrower.

Mechanic's and Construction Lien

Mechanics and contractors can file for this type of lien if they are not paid for the services they offered. In this case, the property can be auctioned in order to get funds to pay the service providers. Subcontractors can also file for this lien if they are not paid by the contractor.

Tax Liens

Tax liens are created by the law. The law allows tax authorities such as Kenya Revenue Authority (KRA), to put liens on properties of tax defaulters. The property owner will therefore not be able to sell the property until they pay their full dues or the property goes to auction to settle the debt. A property tax lien is superior to almost all other types of liens.

Homeowners' Association Liens

Homeowners’ associations have their own rules specific to each area. These rules include remittance of fees to cater for several services such as security and maintenance. If an individual defaults, they are subjected to a lien on their home.

Properties can be subjected to more than one lien. Some liens are voluntary while others are involuntary. In such a case lien priority is applied. Lien priority refers to the order in which liens are paid off in a foreclosure sale.

Liens have priority in the order that they are recorded, based on the “first in time, first in right” rule. This rule automatically places bank and mortgage liens first. However, this can be overruled by the laws put in place by the governing bodies. You will therefore find cases where property tax, mechanic's and homeowners’ liens have been given priority.

-Edited by Emomeri Maryanne