Buying Property at an Auction in Kenya

Winning a property at an auction can work in two different ways; lender confirmation auction, where the lender can reject your offer even if you are the highest bidder, and absolute auction, where the highest bidder gets the property.

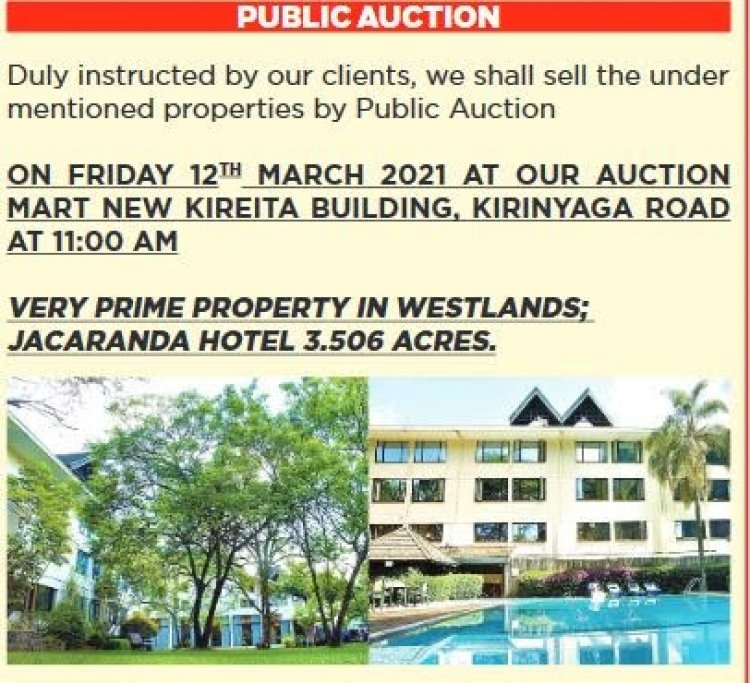

In the recent past, we have had property owned by prominent people in Kenya advertised for auction. They include Njenga Karume’s Jacaranda Hotel in Westlands, Hosea Kiplagat’s home in Karen, Bluewater Hotel in Kisumu owned by Mr. Kosewe of K’Osewe (Ronalo) eateries in Nairobi and Kisumu, and Mocha Place along Kisii-Kisumu Highway owned by the Moracha family. A property can be auctioned in;

1.Foreclosure

This is when a homeowner has not paid the mortgage for a few months and falls into default. Foreclosures are held by bank-hired trustees. The bank will give a notice of default in which the homeowner is supposed to pay the owed balance or renegotiate the mortgage. Failure to do so leads to the property being put up for auction.

Since the homeowner has options to choose from, foreclosure auctions can be postponed or cancelled. For instance, Hosea Kiplagat’s home auctioned was suspended to allow the family to grieve his death. The Court of Appeal also temporarily halted the auction of Mr. Kosewe’s property since he cited disruptions due to the Covid-19 pandemic.

The lender is not allowed to profit from the auction and any profit made is supposed to go to the person whose property has been auctioned.

2.Property Tax Default

If a homeowner fails to pay assessed property taxes, then the property can be auctioned. Here the tax authority takes control. Jacaranda Hotel in Westlands whose auction was also halted was in bad books with Kenya Revenue Authority (KRA) over tax arrears.

Here is the process of buying a property at an auction;

Find Auctioned Properties

Finding a property that is under auction is not hard. You only need to find legit and trusted sources. Auctioned properties are advertised in local newspapers, local banks, home finance groups, auctioneers’ websites, and other government sources such as the judiciary and treasury.

Inspect the Property on Auction

Despite the fact that most properties sold at auction in Kenya are in good condition the only reason for the auction being unpaid mortgage, taxes, or loans, always inspect the property.

Never bid on a property you have not inspected. This will allow you to get the general condition of the property and get value for your money.

Get the Proper Financing

There are a number of ways of financing property under auction. Some auctioneers will want the payment in cash while others will ask for proof that you will pay within a certain period. To show the commitment of buying, auctioneers ask for a deposit in advance and then pay the rest later.

For the Mocha Place, the auctioneers needed a mandatory deposit of Sh. 10 million before taking part in the auction, a deposit of 10 percent at the fall of the hammer during the auction, and the balance to be settled in three months’ period.

You can use a loan or a pre-approved mortgage which comes in handy if you do not have enough money to buy the property out of your pocket. You must borrow the loan before bidding on the property.

Set a Budget

Set a budget for the bid for it will allow you to set the maximum amount of money you will bid on based on the current market value. You can do your research on the recent sales listings.

Also, find out how much the original owner paid for the property. A budget will help you know how much money you need to borrow in form of a mortgage or loan.

Attend the Auction

Attend the auction with enough money to bid. You will need to show proof of financing such as a bank statement or cashier’s cheque. If the auctioneer needs payment in cash at least have a certain percentage of the whole amount.

Register to Get a Bidding Number

Once at the auctioning place register to get a bidding number and fill in the paperwork. The bidding number is used to make the bid, normally the buyer raises it up.

Hold up your Number to Bid

During the auction, the auctioneer will call out a bid on the property. Hold up your number if the price is within your budget. As the bidding continues the price goes up and the last person to hold up the bid is the highest bidder. Winning a property at an auction can work in two different ways; lender confirmation auction, where the lender can reject your offer even if you are the highest bidder, and absolute auction, where the highest bidder gets the property.

Finalize the Transaction

Once you win the bid make sure you finalize the purchase of the property. The buyer is given a certificate or receipt of the sale.

One advantage of buying a property at an auction is the lower price. Agents normally list them based on the unpaid balances and not the original worth.

The biggest risk of buying at an auction is that you will have less information about the property. Always make sure you read and understand all the terms and sign the necessary paperwork.