Housing Affordability in Kenya

Will the 500000 units goal by 2022 be of help? Affordable housing market in Kenya remain a challenge and we have more steps a head before picking up the right path to affordable housing.

Without quality considerations, available data suggests that in both rural and urban areas, 64% of Kenyan households own their accommodation and 36% rent. In urban population, 70% rent houses and only 30% own houses whereas 88% in rural areas own houses and 12% rent.

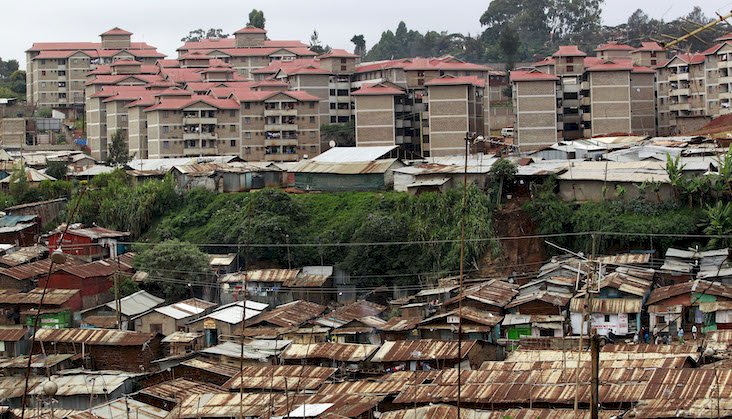

However, the impact of affordable housing is heavily felt in urban areas. For instance, as per Kenya Properties Developers Association-KPDA housing conference, the annual urban population growth rate in Kenya is at 4.2% translating 0.5million new urban immigrants. With this rate, the current housing deficit is about 2million houses with 61% of urban households living in slums.

How demand and supply aggravate the situation.

With rapid urban population growth, demand for housing rises. The annual housing demand is estimated to be 200000 but only ¼ of these homes are built leaving a ¾ deficit each year. According to world bank 2017 publication, Kenya needs 2million more low-income homes to boost its economic growth and the number is likely to increase as time goes by.

House pricing and supply

Housing in Kenya is relatively expensive with low supply. According to the world bank and the CBK, the average price of 1 to 3 bedroom unit was KES 14millions while a 4 to 6 bedroom KES42milions at 2018 prices. For rental residentials, a 1 to 3 bedroom is KES40,000 to 400,000 on average wealthy estates. For middle income earners, the rent is on average 9,000 for a bedsitter, 14,000 for a 1 bedroom and up to 40,000 for a 3 bedroom.

The outstripping demand than supply and the cost incurred to acquire houses has pushed many lower income households live in single rooms and shanties.

For commercial house, rent can be as low as 30,000 and more than 1,000,000 per month depending on their location within the country, sizes and measures considered to value this properties. Further, the sale of commercial properties including house, their value can be high in hundreds of millions Kenya shillings.

How affordable housing is in Kenyan cities.

NAIROBI

Being the largest city and among the oldest towns, it is expected to be more accommodative in housing. But it happens to own one among the biggest slums in Africa (kibera). Houses are quite expensive in Nairobi area. A bedsitter goes for 8000/= in the outcasts of Nairobi where low and middle income families live. In estates such as karen, lang’ata, lavington, runda and more for high income earners, monthly rent for a 3 bedroom on average is more than 450,000. With this it so hard for ordinary people to afford better housing thus increasing population in slums.

MOMBASA AND KISUMU

In Mombasa, Nyali is among the high class estate and expensive housing as well. A 3bedroom here can be sold up to KES17,000,000 or more. For a 3 bedroom house rent can be as low as 35,000 and up to 270,000 per month.

Kisumu relatively cheaper compared to Nairobi and Mombasa.

A bedsitter can range between 6500-8500 while a unit rent can be up to 150000

For commercial houses, it’s quite expensive. You’ll need 300000/= 800000/= as tenancy fee before renting.

Generally, housing in Kenya is too expensive to majority of the population. If 200,000 house are demanded each year then at least 200,000 should be the annual house supply in order to adjust prices to be favorable. If the affordable housing one the 4 agendas remain valid it means 150,000 more houses should be built to cover the deficit each year. Will this be possible? It is only 500000 houses, for how long will this be a satisfaction to the growing demand?

![7 Places with Unique and Beautiful Landscapes in Kenya [PHOTOS]](https://realestateblogpost.com/uploads/images/2023/05/image_380x226_645392c83f0b1.jpg)