4 Key Parties to Guarantee Protection of REITs Interests

Investors can then purchase and sell shares of REITs on the stock market. REITs source funds to build and acquire Real Estate assets, which they sell or rent to generate income.

Real Estate Investment Trusts (REITs) are regulated collective investment ways that allow investors to contribute money’s worth as consideration for the acquisition of rights and interests in a trust that is divided into units with the intention of earning profits or income from Real Estate as beneficiaries of the trust.

Investors can then purchase and sell shares of REITs on the stock market. REITs source funds to build and acquire Real Estate assets, which they sell or rent to generate income. Then at the end of a fiscal year, the generated income is then dispersed as returns (dividends) on investment to the shareholders.

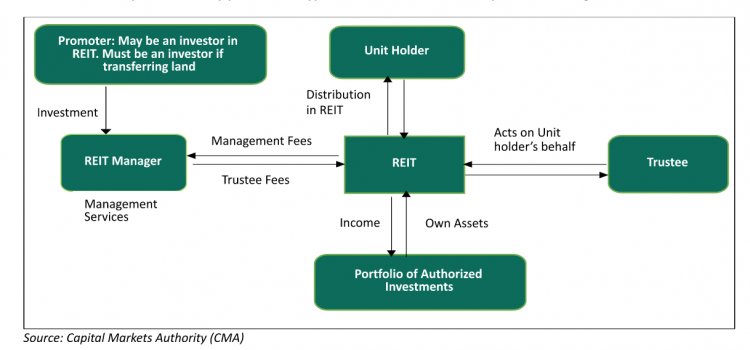

There are four key parties who collaborate to guarantee the protection of REITs interests and to help promote accountability and transparency inside the REIT structure.

They are:

1. The REIT Manager:

This is a company that has been incorporated in Kenya and has been issued a license by the authority, Capital Markets Authority, to provide Real Estate and fund management services for a REIT scheme on behalf of investors. Currently, there are 10 REIT Managers in Kenya they include: Acorn Investment Management, Cytonn Asset Managers Limited (CAML), Stanlib Kenya Limited, Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited.

2. The Trustee

This is a corporation or a company that has been appointed under a trust deed and is licensed by the authority (CMA) to hold the Real Estate assets on behalf of investors. The Trustee’s main role is to act on behalf of the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed. REIT trustees in Kenya include; Kenya Commercial Bank (KCB), Co-operative Bank (Coop), and Housing Finance Bank.

The relationship between key parties in a typical REITs structure is as depicted in the figure below;

3. Project/Property Manager

The role of the project manager is to oversee the planning and delivery of construction projects in the REITs. The property manager on the other hand plays the role of managing the completed Real Estate development that has been acquired by a REIT with his main goal being profit generation.

4. The Promoter

This party is involved in setting up a REIT scheme. The promoter is regarded as the initial issuer of REIT securities and is involved in making submissions to the regulatory authorities to seek relevant approvals of a draft trust deed, draft prospectus, or an offering memorandum. Some of the REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust.

If you have a real estate press release or any other information that you would like featured on African Real Estate Blog Post do reach out to us via email at [email protected]